Unfortunately for some shareholders, Fosun Tourism Group (HKG:1992) The stock is down 31% in the past 30 days, lingering recent pain. The decline ends a disastrous 12 months for shareholders, who have lost 65% in that time.

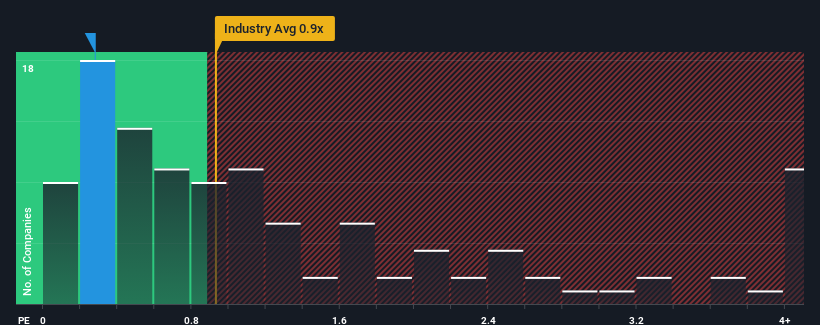

Despite the significant drop in prices, Fosun Tourism Group is still bullish at the moment with a price-to-sales (or “P/S”) ratio of 0.3x, as it accounts for almost half of all companies in the hospitality industry It may be sending a signal. The industry P/S ratio in Hong Kong is over 0.9x, and it is not uncommon for P/S to exceed 3x. Nevertheless, we need to dig a little deeper to determine whether there is a rational basis for the decline in P/S.

Check out our latest analysis for Fosun Tourism Group.

How is Fosun Tourism Group's recent performance?

Recently, there has been no significant difference in revenue growth between Fosun Tourism Group and the industry. Perhaps the market is anticipating a decline in future earnings performance, which is keeping profits and losses suppressed. Those with a bullish view on Fosun Tourism Group would hope otherwise.

If you want to know what analysts are predicting for the future, check out this article. free This is a report from Fosun Tourism Group.

Are revenue projections consistent with low profit and loss margins?

Fosun Tourism Group's P/S ratio is typical for a company with limited growth potential, and importantly, it's performing worse than its industry.

First, looking back, we can see that the company grew its revenue by an impressive 26% over the last year. As a result, its revenue has also increased by a total of 27% over the past three years. So you can start by checking that the company has actually done a good job of growing its earnings over that period.

Looking ahead, 8 analysts who follow the company say that next year's revenue is expected to increase by 14%. On the other hand, the rest of the industry is predicted to expand by 42%, which is significantly more attractive.

Considering this, it is understandable that Fosun Tourism Group's profit and loss is lower than most other companies. Apparently, many shareholders were reluctant to continue holding on to the company, given the possibility that it would lose its future prosperity.

Conclusion on Fosun Tourism Group's performance

Fosun Tourism Group's profit and loss fell along with its stock price. While we typically caution against reading too much into price-to-sales ratios when making investment decisions, they can reveal a lot about what other market participants think about a company. .

As expected, an analysis of Fosun Tourism Group's analyst forecasts confirms that the company's underwhelming earnings outlook is the main reason for its weak P/S. Shareholders' pessimistic view of the company's earnings outlook seems to be the main reason for the low P/S. The company will need to change its fortunes in the future to justify an increase in P/S.

Additionally, you should also learn about these 2 warning signs we've spotted with Fosun Tourism Group (Including 1 which is a bit of a concern).

If you're interested in strong companies that are profitable, then you might want to check this out. free A list of interesting companies that trade at low P/E ratios (but have proven they can grow earnings).

Valuation is complex, but we help make it simple.

Please check it out Fosun Tourism Group Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.